CRYPTO

How MyFastBroker.com Is Changing the Game for Traders

The trading world is no stranger to seismic shifts. From the rise of retail investors to the meme stock mania that made Wall Street sweat, change isn’t just coming—it’s always mid-sprint. But in the eye of today’s fintech storm, one name has been cutting through the noise like a lightning bolt: MyFastBroker.com.

Let’s be clear: This isn’t just another brokerage platform trying to rebrand spreadsheets with a splash of teal and a clean app interface. No, MyFastBroker.com is rewriting the entire rulebook, starting with one deceptively simple mission—to make speed, transparency, and intelligent access the new standard in trading.

Sound ambitious? It is. But ambition is exactly what the trading world has been begging for.

🚀 The First Thing You’ll Notice: It’s Blisteringly Fast

Speed isn’t a luxury in trading—it’s survival. A few milliseconds can be the difference between a breakout and a breakdown, a profit and a punch to the gut. MyFastBroker.com lives up to its name with tech that’s built not just for speed, but blistering, blink-and-you-miss-it velocity.

Their ultra-low latency execution engine isn’t just fast—it’s benchmark-defying. We’re talking fiber-optic direct routes to Tier 1 liquidity providers, AI-optimized routing, and trade execution speeds that have some institutional traders side-eyeing their old-school platforms like dusty relics of a dial-up age.

And here’s the kicker—it’s all packaged for everyone. Not just for hedge fund hotshots or Wall Street veterans. MyFastBroker.com levels the latency playing field.

Translation? If you’ve got the instinct, they’ve got the infrastructure to back it.

🔍 Crystal-Clear Transparency Is Not a Feature. It’s a Philosophy.

Let’s talk about what most brokerages don’t want you to know.

Hidden fees. Slippage excuses. Confusing spreads that feel more like traps than tools.

MyFastBroker.com torches that fog with full-spectrum transparency. Their pricing model is clean, their fee structure is surgically clear, and trade analytics are laid out with forensic precision. You’ll see your P&L broken down to the last cent—and where every cent came from.

But they don’t stop there.

Every trade executed on the platform is accompanied by a Post-Trade Execution Report—a kind of black box flight recorder that shows what happened, when it happened, and what it cost you (or made you). It’s like having a Bloomberg Terminal’s forensic toolkit built right into your trading dashboard.

🧠 Smart Tools for the 2025 Trader

We live in a world where AI curates our playlists, routes our Uber rides, and manages our thermostats. So why are so many traders still using static charts from 2005?

Enter: MyFastBroker.com’s intelligent tool suite.

From predictive analytics to real-time sentiment analysis pulled from global news wires, social media buzz, and even Reddit trends, the platform doesn’t just show you the market—it interprets it. This is next-gen decision support, and it’s built for people who want to outthink the market, not just watch it.

Need a technical breakdown with automated Fibonacci retracements, moving average crossovers, and volatility bands? One click. Want to set up a custom dashboard that feeds you asset-specific news as it breaks? Done. Curious how similar price-action scenarios played out in the past, powered by deep-learning historical simulations? They’ve got you.

In short, MyFastBroker.com doesn’t just arm you with data. It gives you a battle-tested war room.

💼 Institutional Perks, Retail Freedom

The financial world has long operated with a kind of caste system—where institutions get the good stuff, and retail traders get a stripped-down version dressed up with emojis.

MyFastBroker.com says screw that.

Their platform offers deep liquidity pools, access to pre- and post-market trading, and—get this—direct market access (DMA) capabilities usually reserved for professional desks. Even better? You don’t need to be slinging seven-figure portfolios to unlock these features. The whole ethos of MyFastBroker.com is accessibility without compromise.

Retail traders now get the same sharp tools the pros use. That’s not just game-changing—it’s status-quo shattering.

🎓 Education That’s Actually Worth Reading

Let’s face it—most trading “education” looks like it was written by an intern who copy-pasted Investopedia. Dry, generic, and usually outdated.

Not here.

MyFastBroker.com has invested in a premium education hub that reads more like a MasterClass than a user manual. Think high-definition video series featuring hedge fund veterans, interactive market theory simulations, and scenario-based learning models that walk you through what you should have done during past black swan events.

It’s a toolkit designed to build more than just users. It builds strategic thinkers.

🌐 Global Markets, No Borders

Where most brokerages still limit access to a handful of familiar exchanges, MyFastBroker.com has gone full cosmopolitan. You want NYSE, Nasdaq, and LSE? Of course. But how about Euronext, TSE, HKEX, and even emerging markets like B3 in Brazil and the South African JSE?

The platform gives traders the geographic reach of a multinational, with seamless forex conversion, localized compliance navigation, and trading hours that follow the sun.

For the modern trader who thinks globally, this is your passport.

🧩 Customization That Actually Understands You

Here’s the thing—every trader is different. Swing, scalper, options savant, crypto cowboy, or dividend devotee. Yet most platforms still operate on a one-size-fits-all mentality.

MyFastBroker.com smashes that mold with a hyper-customizable UX. You build your dashboard like you’d build your dream garage. Plug in only what you need. Arrange it how you want. Save different layouts for different strategies. Set alerts that don’t just ping you—but explain why.

It’s intuitive, responsive, and freakishly good at adapting to your trading DNA.

🤝 A Community of Killers (in the Best Way)

There’s something electric about a platform where serious traders gather. Not keyboard cowboys, but focused minds who breathe volatility, eat indicators for breakfast, and analyze candle wicks in their sleep.

MyFastBroker.com isn’t just a brokerage—it’s building a tight-knit trader network that feels like the MIT poker team of markets. From invite-only Discord chats to live strategy hackathons and virtual trading floors, the platform fosters an environment of collaborative brilliance.

And when you surround yourself with sharp minds, your edge sharpens too.

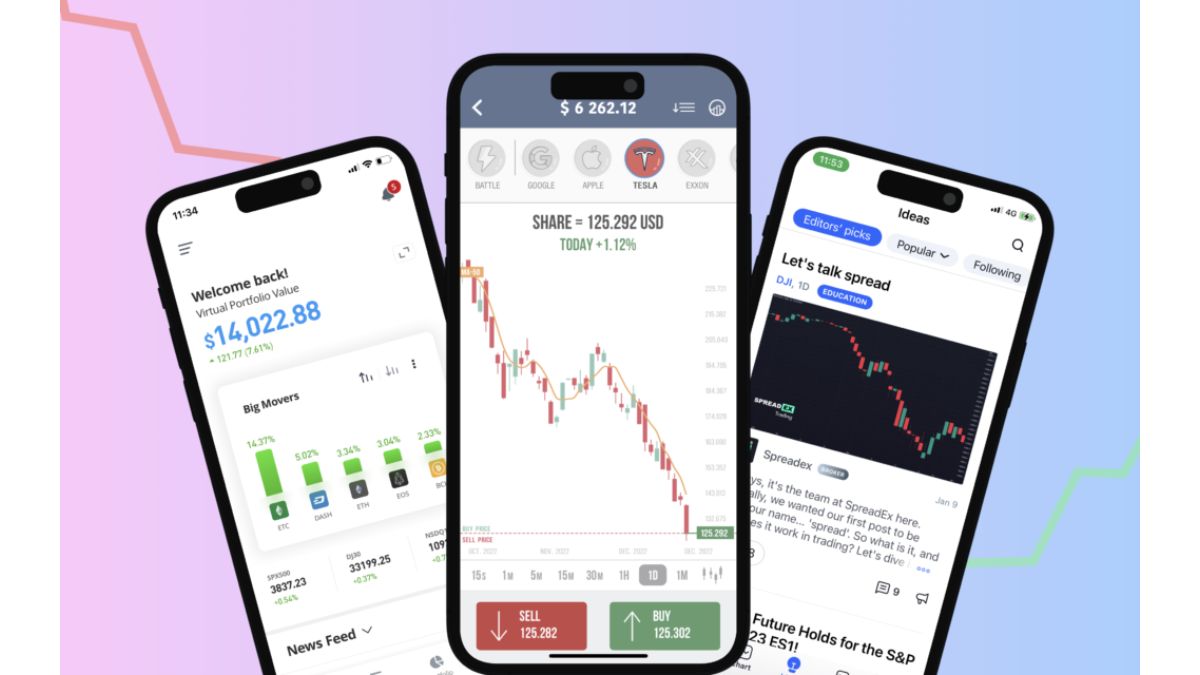

📱 Mobile Trading That Doesn’t Suck

Let’s be real. Most mobile trading apps are watered-down versions of the main site—barebones, sluggish, and as ergonomic as a fax machine.

Not MyFastBroker.com.

Their mobile interface is built native-first, meaning every feature—from chart analysis to multi-leg option trades—works seamlessly on iOS and Android. The UI is crisp, the execution is lightning-fast, and the alerts system? Chef’s kiss.

Because trading isn’t a desk job anymore. And they get that.

🔐 Security That’s CIA-Level Tight

If you’re trusting a platform with your funds and your data, security better be more than an afterthought.

MyFastBroker.com has bank-grade encryption, biometric access controls, multi-factor authentication, cold-storage for sensitive data, and an independent team of white-hat hackers stress-testing the system weekly.

And if anything ever goes sideways? They’ve got 24/7 live support—not a chatbot named “Timothy” who loops you back to the FAQ page.

📊 Analytics That Make You a Sharper Trader

Most traders think they know their strengths—until the data tells a different story.

MyFastBroker.com includes an advanced Trader Performance Dashboard, tracking everything from your most profitable trade types to the times of day you tend to underperform. It’s like having a personal coach in your corner, whispering brutal truths and breakthrough insights.

For serious traders, it’s the edge you didn’t know you needed.

🎤 Final Word: This Isn’t Evolution. It’s Revolution.

In a world where brokers are still catching up to last year’s innovations, MyFastBroker.com is out here launching the next decade of trading evolution—today.

It’s not just faster. It’s smarter. Sharper. Cleaner. More empowering. And unapologetically built for traders who refuse to settle for “good enough.”

Whether you’re a seasoned vet or a newly-minted market junkie, MyFastBroker.com isn’t just changing the game—it’s changing the player.

CRYPTO

Top Features of Gocryptobet.com You Didn’t Know About

Are you ready to explore the exciting world of online gaming? If so, gocryptobet.com might just be your next favorite destination. This innovative platform combines the thrill of gambling with cutting-edge technology, offering users a unique experience that sets it apart from traditional betting sites. Whether you’re a seasoned player or new to the scene, there’s something for everyone at Gocryptobet. From an extensive selection of games to impressive security features, this site is designed with players in mind. Join us as we delve into some of the top features of gocryptobet.com that you may not know about yet!

The Benefits of Using Gocryptobet.com

Gocryptobet.com offers a seamless gambling experience for cryptocurrency enthusiasts. With its intuitive design, players can easily navigate through games and features.

One of the standout advantages is the diverse selection of cryptocurrencies accepted. This flexibility allows users to choose their preferred digital currency without hassle.

Additionally, Gocryptobet.com emphasizes security and privacy. Players can enjoy peace of mind knowing that transactions are encrypted and personal data remains confidential.

The platform also provides various gaming options, from classic casino games to innovative crypto-specific offerings. This variety ensures there’s something for everyone, catering to both seasoned gamblers and newcomers alike.

Moreover, regular promotions keep things exciting. Users often find themselves benefiting from generous bonuses that enhance their gameplay experience further.

Unique Features of Gocryptobet.com

Gocryptobet.com stands out in the crowded online gambling landscape with its distinctive offerings. One feature that grabs attention is its fully decentralized platform, giving players more control and privacy over their gaming experience.

The site also integrates an innovative staking system. Users can earn rewards by holding certain cryptocurrencies while engaging in games. This adds a layer of strategy to the fun.

Another unique aspect is the live betting option on various sports events. Gamers can wager on matches as they unfold, adding excitement to traditional betting experiences.

Additionally, Gocryptobet offers tailored game recommendations based on user preferences. This personalized touch enhances user engagement and keeps players coming back for more thrilling action.

Advanced Security Measures

Gocryptobet.com prioritizes your security above all else. Advanced encryption technologies safeguard your data, ensuring that every transaction remains confidential and protected from prying eyes.

The platform employs two-factor authentication (2FA), adding an extra layer of protection to your account. This feature requires both a password and a secondary verification method, making unauthorized access virtually impossible.

Regular security audits are conducted to identify potential vulnerabilities. These proactive measures help maintain the integrity of the site and keep it safe for users.

Additionally, Gocryptobet.com utilizes cold storage for cryptocurrencies. By keeping most funds offline, they minimize risks associated with hacking attempts or server breaches.

With these robust security protocols in place, users can engage confidently on Gocryptobet.com without worrying about their safety.

User-Friendly Interface and Navigation

Navigating Gocryptobet.com is a breeze. The platform boasts an intuitive layout that welcomes both beginners and experienced users alike.

With a clean design, everything you need is just a click away. You won’t have to sift through cluttered menus or confusing tabs. Each section flows seamlessly, making your betting experience smooth and enjoyable.

The search functionality stands out too. Want to find your favorite game? Just type it in, and voila! It’s right there for you.

Mobile users will appreciate the responsive design as well. Whether on your phone or tablet, the interface maintains its clarity and ease of use.

Quick access to essential features like account settings, deposits, and withdrawals enhances user satisfaction significantly. Everything feels streamlined and efficient from start to finish on Gocryptobet.com.

Multiple Cryptocurrency Support

Gocryptobet.com stands out with its extensive support for multiple cryptocurrencies. Users can transact using popular options like Bitcoin, Ethereum, and Litecoin, among others. This flexibility caters to both seasoned investors and newcomers.

The platform allows for seamless deposits and withdrawals across various digital currencies. You can easily switch between coins depending on market trends or personal preferences.

Moreover, having the option to use different cryptocurrencies enhances the overall gaming experience. Players can enjoy their favorite games without worrying about currency limitations.

This multi-coin support not only broadens accessibility but also attracts a diverse user base from around the globe. Whether you prefer traditional coins or newer altcoins, Gocryptobet.com has got you covered.

Exciting Bonuses and Promotions

Gocryptobet.com stands out with an array of captivating bonuses and promotions that keep players engaged. New users can kick off their journey with a generous welcome bonus, giving them extra funds to explore the platform’s offerings.

Regular players are not forgotten either. Loyalty programs reward consistent play, allowing users to accumulate points that lead to exclusive perks and benefits. This creates a sense of community and appreciation among frequent visitors.

Seasonal promotions add an element of excitement throughout the year. From holiday-themed bonuses to special event giveaways, there’s always something fresh on offer.

These incentives not only enhance gaming experiences but also maximize potential winnings for all participants. With Gocryptobet.com, every login feels like an opportunity waiting to be seized.

24/7 Customer Support

Gocryptobet.com takes customer service seriously. Their 24/7 support ensures that help is always just a click away.

Whether you’re new to the platform or a seasoned player, questions can arise at any time. The dedicated support team is available around the clock to assist with account issues, game inquiries, or technical difficulties.

You can reach out through multiple channels like live chat and email. This flexibility means you get timely responses without waiting long periods for answers.

The representatives are knowledgeable and patient, making it easier to resolve any problems quickly. Users often praise their ability to provide solutions efficiently.

This commitment to constant availability sets Gocryptobet.com apart in the competitive landscape of online gaming platforms. A supportive environment enhances user experience, allowing players to focus on what truly matters—enjoying their games.

How to Get Started on Gocryptobet.com

Getting started on Gocryptobet.com is simple and straightforward. Begin by visiting the website and creating an account. Click on the sign-up button, fill in your details, and verify your email address.

Once registered, you can deposit funds using various cryptocurrencies. Select your preferred method from the options available. The platform supports popular coins like Bitcoin, Ethereum, and more.

After funding your account, explore the extensive range of games offered. You’ll find slots, table games, and live dealer experiences that cater to every type of player.

Don’t forget to check out ongoing promotions. These bonuses can boost your initial deposits or provide free spins on selected games.

Familiarize yourself with Gocryptobet’s user-friendly interface for easy navigation throughout the site.

Conclusion

Gocryptobet.com offers a comprehensive platform for those looking to engage with online gaming and cryptocurrency in an innovative way. With its unique features, advanced security measures, and user-friendly interface, it stands out in the crowded market of online betting platforms.

The diverse range of cryptocurrencies supported allows players to transact easily and securely, catering to various preferences. The exciting bonuses and promotions enhance the overall experience, keeping users engaged while providing added value.

With 24/7 customer support available at your fingertips, help is always close by should any questions or issues arise.

If you’re seeking a reliable online betting site that combines cutting-edge technology with robust features, Gocryptobet.com may just be the right choice for you. Whether you’re a seasoned gambler or new to the scene, exploring this platform could offer you more than you expect.

CRYPTO

Stay Ahead of the Curve: Exploring FintechZoom.com Crypto News

Introduction to FintechZoom.com Crypto News

In the fast-paced world of finance, staying informed is crucial—especially when it comes to cryptocurrencies. As digital currencies continue to reshape our financial landscape, having access to timely and accurate news becomes increasingly important. Enter FintechZoom.com Crypto News—a platform dedicated to providing insights into the latest happenings in the crypto market. Whether you’re a seasoned investor or just starting out, understanding the trends and developments can give you an edge in this ever-evolving space. Let’s dive deeper into why keeping up with FintechZoom.com Crypto News is essential for anyone interested in cryptocurrency investments.

The Growing Importance of Crypto News

The landscape of finance is transforming rapidly. Cryptocurrency has emerged as a pivotal player in this evolution, driving the need for timely and accurate news coverage.

Market volatility makes it essential for investors to stay informed. The slightest shift can lead to significant gains or losses. Accessing reliable crypto news empowers individuals to make educated decisions.

Moreover, with an increasing number of projects launching daily, understanding market dynamics is crucial. New regulations and technological advancements further complicate the narrative surrounding cryptocurrencies.

As mainstream adoption grows, so does public interest in crypto markets. This surge demands thorough reporting on trends and events that shape the industry’s future.

Staying updated helps both seasoned traders and novices navigate this complex realm effectively. Without real-time insights into market movements or emerging technologies, one risks falling behind in an ever-evolving environment.

Top Cryptocurrencies and Their Market Performance

Bitcoin continues to lead the cryptocurrency market, often regarded as digital gold. Its price movements can significantly impact investor sentiment across the board.

Ethereum follows closely behind, thanks to its smart contract capabilities and growing adoption in decentralized finance (DeFi). The transition to Ethereum 2.0 has sparked excitement about scalability and sustainability.

Binance Coin has captured attention with its utility on the Binance exchange and various DeFi projects. Its consistent performance showcases a strong community backing and use case.

Cardano stands out for its proof-of-stake mechanism, aiming for energy efficiency while fostering an ecosystem of dApps. Investors are keenly watching its developments as it rolls out new features.

Solana is making waves due to its high-speed transactions and lower fees, attracting developers looking for robust platforms. Each of these cryptocurrencies plays a unique role in shaping market dynamics today.

Latest Developments and Trends in the Crypto Industry

The crypto industry is constantly evolving. New technologies and innovations are shaping the landscape daily. One of the most talked-about trends is decentralized finance (DeFi). This movement allows individuals to engage in lending, borrowing, and trading without traditional intermediaries.

Regulatory changes also play a significant role. Governments worldwide are beginning to create frameworks that could impact how cryptocurrencies operate. These regulations aim for security while promoting innovation.

Another trend gaining momentum is non-fungible tokens (NFTs). Artists and creators are leveraging NFTs to monetize their digital works uniquely. The market continues to grow as more people recognize the value of owning exclusive digital assets.

Sustainability has entered the conversation too, with projects looking at eco-friendly mining solutions. As these developments unfold, they highlight an industry ripe with opportunities and challenges alike. Staying informed on these trends ensures you remain ahead in this fast-paced environment.

How FintechZoom.com Stands Out in Delivering Crypto News

FintechZoom.com distinguishes itself by delivering crypto news with clarity and precision. The platform emphasizes real-time updates, ensuring readers are never out of the loop on market fluctuations.

What sets FintechZoom apart is its commitment to in-depth analysis. Each article dives deeper than surface-level headlines, providing insights that help investors make informed decisions.

User experience is also a priority. The website boasts an intuitive layout, allowing users to navigate effortlessly through various topics and stay updated without hassle.

Additionally, FintechZoom collaborates with industry experts for exclusive interviews and opinions. This access gives readers unique perspectives that aren’t commonly found elsewhere.

With a focus on quality content curated from reliable sources, it builds trust among its audience. Staying ahead in the fast-paced world of cryptocurrency requires accurate information—something FintechZoom consistently delivers.

Benefits of Staying Updated with Crypto News on FintechZoom.com Crypto News

Staying updated with crypto news on FintechZoom.com offers numerous advantages. For one, it keeps investors informed about market fluctuations that can impact portfolio decisions. Knowledge is power in the volatile world of cryptocurrencies.

Access to real-time updates helps users spot trends early. Being among the first to know about developments can lead to strategic investments and better financial outcomes.

FintechZoom.com delivers comprehensive insights from industry experts. This expertise enriches your understanding of complex topics, making it easier to navigate the fast-paced crypto landscape.

Additionally, regular updates foster a sense of community with other enthusiasts and professionals. Engaging with like-minded individuals enhances learning experiences and encourages discussions around new ideas or strategies.

With its user-friendly interface, FintechZoom.com ensures that vital information is just a click away. Staying connected has never been simpler for anyone eager to explore cryptocurrency’s potential fully.

Conclusion: FintechZoom.com Crypto News

Staying informed in the fast-paced world of cryptocurrencies is crucial for investors and enthusiasts alike. FintechZoom.com Crypto News serves as a reliable source to navigate this dynamic landscape. With timely updates, expert insights, and comprehensive coverage of market movements, it empowers readers to make informed decisions.

By keeping an eye on top cryptocurrencies and their performance metrics or learning about the latest trends shaping the industry, you can gain a competitive edge. The unique approach taken by FintechZoom.com ensures that all information is easily digestible, making it accessible for everyone—from novices to seasoned traders.

Embracing these resources will not only enhance your understanding but also help you stay ahead in your investment strategies. Regularly visiting FintechZoom.com Crypto News can be a game-changer for anyone looking to thrive amidst volatility and opportunity within the crypto markets.

Stay Ahead of the Curve: Exploring FintechZoom.com Crypto News

Introduction to FintechZoom.com and Crypto News

In an ever-evolving digital landscape, staying informed about cryptocurrency trends is crucial for investors and enthusiasts alike. As the crypto market continues to grow at a breakneck pace, access to reliable information becomes more important than ever. Enter FintechZoom.com Crypto News—a platform dedicated to providing timely updates, expert analysis, and insights into the dynamic world of cryptocurrencies. Whether you’re a seasoned trader or just starting your journey in crypto, understanding where to find trustworthy news can make all the difference in navigating this volatile space. Let’s dive deeper into what makes FintechZoom.com the go-to source for all things crypto.

The Rise of Cryptocurrencies and the Need for Reliable Crypto News

The landscape of finance is evolving rapidly. Cryptocurrencies have surged in popularity, capturing the attention of investors and tech enthusiasts alike. With innovations like Bitcoin and Ethereum leading the charge, digital currencies are reshaping traditional financial paradigms.

As this market expands, so does the demand for accurate information. Investors need reliable news sources that provide timely updates on price movements, regulatory changes, and emerging technologies. Misinformation can lead to significant losses in such a volatile environment.

Platforms focused on delivering trustworthy crypto news play a crucial role. They help users navigate through hype and speculation by offering well-researched insights. This accessibility empowers individuals to make informed decisions rather than relying on rumors or social media chatter.

In this fast-paced world of cryptocurrencies, staying updated is not just beneficial; it’s essential for anyone looking to thrive in this dynamic space.

What Sets FintechZoom.com Apart in the World of Crypto News?

FintechZoom.com stands out in the crowded landscape of crypto news for several reasons. First, it prioritizes accuracy and transparency. Readers can trust that the information presented is well-researched and verified, which is crucial in such a volatile market.

The platform offers a user-friendly interface designed with readers in mind. Navigating through various sections feels seamless, helping users find relevant articles quickly.

Another distinctive feature is its diverse range of content. From breaking news to analytical pieces, FintechZoom covers every angle of the cryptocurrency world. This breadth allows investors and enthusiasts alike to gain comprehensive insights.

Moreover, FintechZoom partners with industry experts to provide unique perspectives on emerging trends. These expert opinions elevate the quality of discourse surrounding cryptocurrencies and blockchain technology.

With timely updates and a commitment to education, FintechZoom.com ensures its audience remains informed about significant shifts within this dynamic sector.

CRYPTO

Maximizing Returns with Crypto30x.com Gemini

When it comes to navigating the world of cryptocurrency, having the right tools and knowledge at your fingertips can make all the difference. Crypto30x.com Gemini is one such platform that provides investors with an unrivaled combination of expert curation, market insights, and advanced trading capabilities, all designed to help you maximize your returns.

If you’re ready to optimize your crypto portfolio and unlock the full potential of the crypto market, this guide will walk you through actionable strategies for using Crypto30x.com Gemini effectively. From portfolio management to risk mitigation, these tips will help you thrive in the fast-paced world of digital assets.

Why Choose Crypto30x.com Gemini?

Before we jump into the strategies, let’s take a moment to understand why Crypto30x.com Gemini is the perfect platform for growing your crypto portfolio. Here’s what sets it apart:

- Comprehensive Market Insights: Stay informed with the latest news, analysis, and tutorials covering cryptocurrencies, DeFi, blockchain technology, and more.

- Advanced Trading Tools: Utilize cutting-edge features for real-time tracking, price monitoring, and trading execution.

- Educational Guides: Perfect for beginners and experts alike, its resources help demystify complex crypto concepts.

- Community Engagement: Join a thriving network of crypto enthusiasts and exchange valuable insights.

Now, let’s explore how you can make the most of Crypto30x.com Gemini.

1. Build a Diversified Crypto Portfolio

Diversification is key to mitigating risk in the volatile crypto market, and Crypto30x.com Gemini makes it easy with its wide array of cryptocurrencies. Use these tips to get started:

How to Diversify

- Mix of Coins: Include a range of assets like Bitcoin, altcoins (e.g., Ethereum, Solana), and niche coins with growth potential.

- Stablecoins: Consider adding stablecoins like USDT or USDC to balance the volatility of your portfolio.

- DeFi Projects: Explore decentralized finance tokens that power game-changing financial ecosystems.

Pro Tip:

Use Crypto30x.com Gemini’s market research tools to evaluate historical performance, sentiment analysis, and emerging trends for informed decision-making.

2. Leverage Data Insights for Strategic Investing

Crypto markets move fast, but informed decisions can give you a competitive edge. Here’s how to capitalize on the extensive data offered by Crypto30x.com:

- Track Real-Time Data: Monitor price movements and trade volumes for potential entry and exit points.

- Analyze Treading Trends: Keep an eye on trending coins and tokens featured on the platform.

- Use Market Forecasts: Utilize price charts and patterns to predict behavior and enhance your strategy.

Bonus:

Crypto30x.com Gemini also offers tasting notes-style insights, breaking down each cryptocurrency’s strengths and potential scenarios. Use these to better understand your chosen investments.

3. Take Advantage of DeFi and Layer 2 Projects

Crypto30x.com Gemini helps you tap into the evolving world of decentralized finance (DeFi) and Layer 2 solutions. These areas are growth hotspots that forward-thinking investors can’t ignore.

DeFi Opportunities Include:

- Staking Rewards: Earn passive income by locking your tokens on validated DeFi platforms.

- Yield Farming: Explore high-interest opportunities with borrowing and lending protocols.

- Decentralized Exchanges (DEXs): Trade directly on blockchain networks with no intermediaries.

Layer 2 solutions like Polygon or Arbitrum are transforming scalability and speed for blockchains. Crypto30x.com Gemini offers guides tailored to exploring these cutting-edge innovations.

Start Exploring:

Follow Crypto30x’s step-by-step tutorials to get hands-on experience in staking, liquidity pools, or understanding particular protocols.

4. Focus on Risk Management

The crypto market is infamous for its volatility, but risk management techniques can mitigate potential losses. Crypto30x.com Gemini includes tools to help you stay on the safe side.

Tools for Risk Mitigation:

- Limit and Stop-Loss Orders: Use these features to set automated trades and protect your investments from sudden price shifts.

- Portfolio Balance Tracker: Analyze your investment spread to ensure you’re not overly reliant on one asset.

- Educational Articles: Access guides on evaluating project credibility and recognizing red flags in an unregulated market.

Pro Tip:

Follow Crypto30x’s scam avoidance guides to stay one step ahead while investing.

5. Get Exclusive Benefits as a Community Member

Crypto30x.com Gemini isn’t just a platform—it’s also a gateway to a vibrant community of enthusiasts, investors, and experts. The benefits of joining include:

- Subscriber-Only Perks: Access exclusive deals and early alerts for newly listed tokens.

- Collaborative Knowledge: Share strategies, learn from others, and stay motivated within a supportive space.

- Live Webinars: Stay updated with interactive sessions featuring crypto thought leaders.

Sign up for their newsletter to enjoy these perks and take part in shaping the community.

6. Take Advantage of Expert Curation

One of Crypto30x.com’s key strengths is its expert guidance. Through thoroughly researched market reviews, the platform delivers insights that cut through the noise and help you focus on what matters.

How to Leverage Expert Input:

- Compare Projects: Save time by reading curated comparisons instead of sifting through disparate sources.

- Follow Recommendations: Use highlighted picks to identify high-growth areas or actionable trends.

- Deepen Your Knowledge: Take advantage of guides to better understand on-chain metrics or new technologies.

Closing Thoughts: Supercharge Your Portfolio Today

Crypto investing requires agility, knowledge, and the right tools. Crypto30x.com Gemini combines all three into one powerful platform, making it easier than ever to strategize, invest, and succeed.

Whether you’re just starting or looking to improve your results, the tips shared here offer a roadmap for enhancing your returns. Now is the time to act—sign up with Crypto30x.com Gemini today and unlock your portfolio’s potential!

-

BUSINESS6 months ago

BUSINESS6 months agoBoost Your Brand with adsy.pw/hb3 Digital Solutions

-

BUSINESS7 months ago

BUSINESS7 months agoTransform Your Business with MyWape

-

TOPIC5 months ago

TOPIC5 months agoHow ATFBoru is Shaping Online Interaction in Unique Ways

-

TOPIC6 months ago

TOPIC6 months agoHow Appfordown Simplifies Your App Experience: Tips and Tricks

-

TOPIC8 months ago

TOPIC8 months agoWhy Wepbound is Revolutionizing the Way We Connect Online

-

TOPIC6 months ago

TOPIC6 months agoSpeedyShort.com: Tips and Tricks for Effective Link Sharing

-

TOPIC7 months ago

TOPIC7 months agoBehind the Screen: The Stories and Secrets of m0therearf

-

TOPIC6 months ago

TOPIC6 months agoSimpcitt Decoded: Unlocking the Meaning Behind the Buzz